I am not an accountant. I much prefer taking photos and playing around with designs, then I do filling out my tax return. Plus, sometimes the world of accounting can seem like learning a foreign language to me. But it has to be done at some point.

Like most things in life, it does us no good to sit around and avoid tax time like the plague. And like I said before I am no expert on this matter. So instead of taking the avoidance route, I talked to the experts and these are their top tips for tackling tax season.

https://www.instagram.com/p/BZ4dXXlgLT6/?taken-by=thefitfoodieblog

Make the most of the sharing economy

As a small business owner, it's essential that you know how to draw on the sharing economy. If you've got your own business, you can make the most of platforms like Airtasker and Fiverr to outsource work like design, video production or copywriting at affordable rates. Or if you're freelancing and you want to remain competitive, you should be advertising your services via these sites so your bringing in new business.

In fact, recent finder.com.au research shows 1 in 5 Australians have used the sharing economy to create an additional income stream with 22% of all Australians have a ‘side hustle’ driving Uber, renting out rooms on Airbnb or running errands on Airtasker. However, keep in mind that the sharing economy is not a tax-free economy and you will need to declare this income at tax time. Being savvy with apps is another way to ensure you stay on top of your finances. - Bessie Hassan, Money Expert from finder.com.au

Be ready for when the tax man comes knocking

Operating a business means you need to understand your tax obligations and the deductions you can make at tax time. Whether it's knowing what paperwork to hold onto, recruiting a qualified accountant, or knowing what tax breaks you're eligible for, there are plenty of ways to practice due diligence prior to the end of financial year (EOFY). Being organised throughout the year will make the process a whole lot smoother when it comes to submitting your return. - Bessie Hassan, Money Expert

Educate yourself, but don't be afraid to ask for help

Unless you have a really complicated personal situation, learn to use the ATO record keeping app (myDeductions) and self-lodging system (currently myTax run through myGov). Lodging your own tax return is easy and you will save yourself a small fortune in accountants fees. A good accountant can give great advice on budgeting and investing and can tell you the best way to organise your financial situation to minimise your tax and maximise your personal wealth. - Stacey Beaumont, Lecturer at UQ Business School

Know when to claim, and when not to claim

Make sure your expenses are connected to your income earning activities! We see so many instances where taxpayers believe they can claim an expense that actually did not directly relate to their income earning activities. One thing you must know - keep your receipts! If you don't have a receipt, it didn't happen. - Suzanne Faulkner, from Xact Accounting

What are your fave tips for getting through tax time? Let us know down below.

Follow me: @thefitfoodieblog

PIN ME FOR LATER:

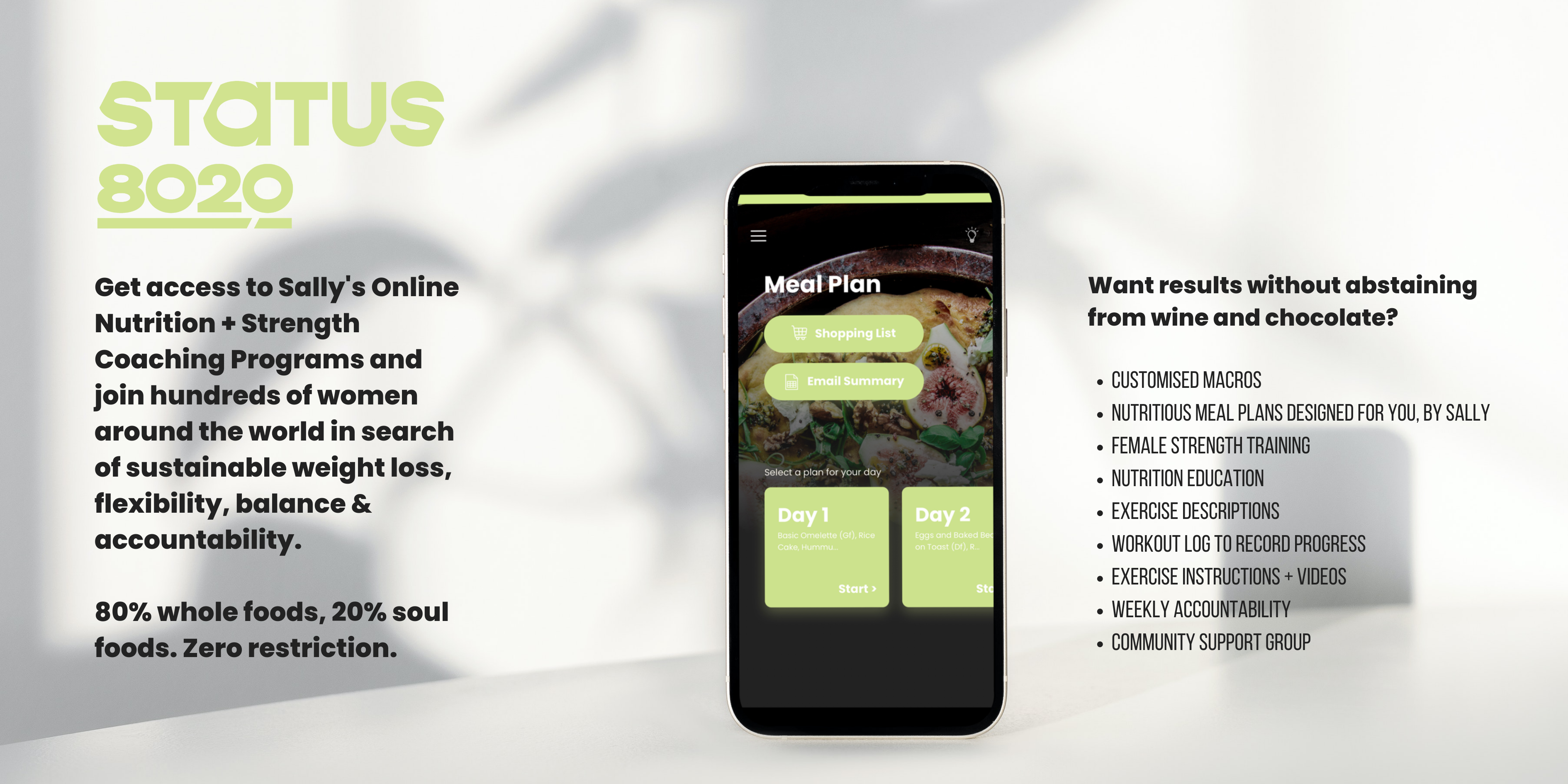

At The Fit Foodie Blog, we love to channel our inner girl bosses and share with you useful tips and tricks to take your business to the next level. To do this we love collaborating with people who work in the area because we are more creatively and foodie inclined than we are money inclined. And just like there is no one diet that fits all, there is no one guide to tackling the nitty gritty when it comes to your business. Whilst we try our best to give your guys the best advice around, this is never a substitute for speaking to a professional.